LTC Price Prediction: Path to $200 Amid Market Volatility and ETF Speculation

#LTC

- Technical indicators show LTC trading below key moving averages but with some bullish MACD momentum

- Regulatory developments and ETF approvals could serve as significant price catalysts

- Market sentiment remains cautious amid broader cryptocurrency volatility and sell-offs

LTC Price Prediction

LTC Technical Analysis: Current Market Position and Indicators

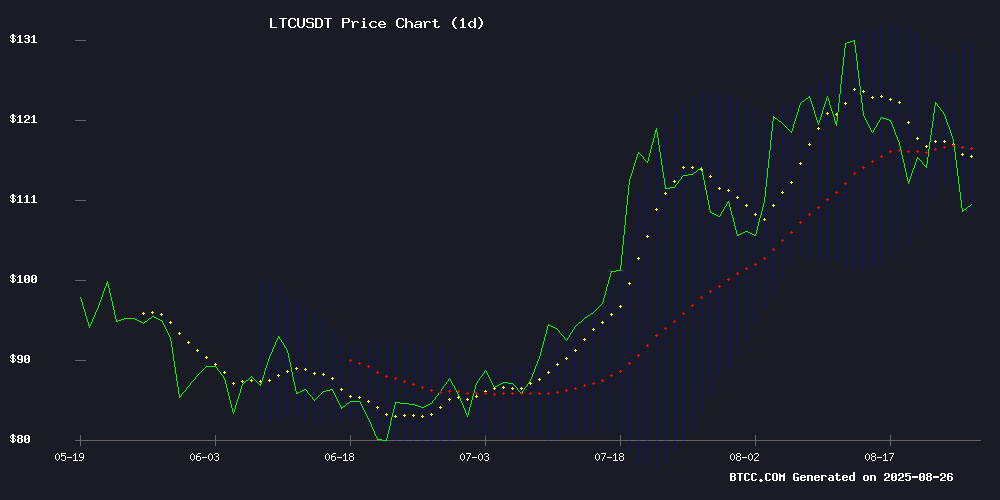

LTC is currently trading at $110.11, below its 20-day moving average of $119.87, indicating potential short-term bearish pressure. The MACD reading of 3.91 with a positive histogram of 4.37 suggests some bullish momentum despite the price being below the moving average. Bollinger Bands show LTC trading NEAR the lower band at $108.91, which could indicate an oversold condition and potential support level.

According to BTCC financial analyst Emma, 'The technical picture shows mixed signals - while price action is weak relative to the moving average, the MACD suggests underlying strength. A break above the middle Bollinger Band around $120 could signal a shift in momentum.'

Market Sentiment: Regulatory Delays and ETF Developments Impact Altcoins

Current market sentiment is cautious as SEC delays continue to stall momentum in the altcoin space. The filing for an 'American-Made' crypto ETF that may include major altcoins creates both opportunity and uncertainty. Recent sharp declines across cryptocurrencies reflect ongoing volatility and investor nervousness.

BTCC financial analyst Emma notes, 'The ETF developments represent a potential catalyst for LTC and other altcoins, but regulatory hurdles remain significant. Market sentiment is currently weighed down by broader sell-offs, though selective Optimism exists for quality assets like LTC that may benefit from future ETF inclusions.'

Factors Influencing LTC's Price

Altcoin Rally Awaits ETF Launch as SEC Delays Stall Market Momentum

The crypto market's anticipated altcoin season remains on hold as regulatory delays impede progress. Bitfinex analysts suggest a sustained rally won't materialize until spot exchange-traded funds for major altcoins gain approval. Over a dozen ETF proposals—including products tracking Solana (SOL), XRP, and Litecoin (LTC)—face ongoing SEC review despite industry optimism about eventual approvals.

Market liquidity shows early signs of accumulation, but analysts predict significant capital rotation won't occur until altcoin ETFs enter the market. The regulatory bottleneck has created a holding pattern, with traders awaiting the demand surge expected from institutional-grade investment vehicles. Some proposals reportedly carry approval probabilities as high as 95%, suggesting the delay may represent procedural caution rather than outright rejection.

Canary Files for 'American-Made' Crypto ETF—Will XRP, Solana and Cardano Make the Cut?

Canary Capital has filed for a "Made in America" crypto ETF, aiming to provide exposure to U.S.-originated or U.S.-backed digital assets. The proposed fund would track the Made-in-America Blockchain Index, focusing on cryptocurrencies with significant mining or staking operations in the United States.

Solana, XRP, and Cardano—all founded by Americans—are likely candidates for inclusion, according to CoinGecko's classification. The ETF's approval hinges on SEC review, with trading slated for the Cboe BZX Exchange.

This marks Canary Capital's latest move in a series of altcoin ETF applications, including filings for Litecoin and TRON vehicles. The firm has yet to disclose the full roster of assets under consideration.

Cryptocurrency Market Experiences Sharp Decline Amid Bitcoin and Altcoin Sell-Off

The cryptocurrency market faced a significant downturn late Sunday into early Monday, with Bitcoin (BTC) leading the decline after a brief rally on Friday. BTC, which had maintained a position above $115,000 over the weekend, dropped to an intraday low of $110,635 before stabilizing around $111,699—a nearly 3% loss in 24 hours.

Ethereum (ETH) briefly reached a new all-time high of $4,953 before retreating to $4,608, shedding over 3% of its value. Other major altcoins followed suit: Ripple (XRP) fell 2.98% to $2.94, Solana (SOL) tumbled below $200 to trade around $198, and Dogecoin (DOGE) dropped 4.80%. Cardano (ADA), Chainlink (LINK), and Polkadot (DOT) also registered notable losses.

The sell-off extended to smaller-cap assets, with Stellar (XLM), Hedera (HBAR), Litecoin (LTC), and Toncoin (TON) all posting substantial declines. Market sentiment appears to have shifted following Friday's rally, though Ethereum's brief record high suggests lingering bullish momentum for select assets.

Will LTC Price Hit 200?

Based on current technical indicators and market conditions, reaching $200 for LTC presents significant challenges in the near term. The coin would need to appreciate approximately 82% from its current level of $110.11, which would require substantial bullish catalysts and improved market sentiment.

| Target Price | Required Gain | Key Resistance Levels | Probability Factors |

|---|---|---|---|

| $200 | +82% | $130 (Upper Bollinger), $150, $180 | ETF approval, broader market rally, increased adoption |

BTCC financial analyst Emma suggests, 'While $200 is not impossible, it would require a perfect storm of positive developments including successful ETF inclusions, regulatory clarity, and renewed institutional interest. Current technical levels suggest more immediate resistance around $130-140 range.'